Why Luna Crash Has Raised Questions About Stability of Crypto Assets

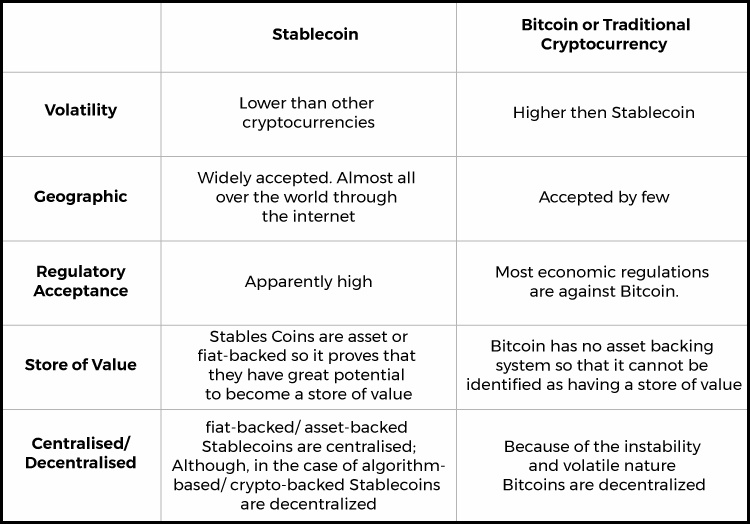

Cryptocurrency prices have been known to fluctuate wildly. It’s not unusual for the cryptocurrency market to be hit by sudden price drops. But there are some types of digital currency called ‘stablecoins’ whose value is designed to stay steady.

Stablecoins became popular in the past couple of years as they offered a solution to the volatility problem: they are backed by an asset that is relatively stable in price, such as cash or gold. However, the last few weeks have shown that even stablecoins are not immune from volatility. The recent crash of the TerraUSD and Luna stablecoins took many investors by surprise. But what happened?

The TerraUSD, an algorithmic stablecoin, has been around for a year and is one of the most popular stablecoins on the market. However, on May 9, 2022, it began trading at around 0.11 cents per token – an incredible drop from its original price of one dollar per coin!

In addition to TerraUSD’s price drop, its sister coin Luna also experienced similar losses over the same period: dropping from an all-time high of $119.18 on April 5, 2022 down to just $0.00001675 on May 13, according to coinmarketcap data.

The sudden collapse of the stablecoin TerraUSD and Luna has therefore been a cause for concern among investors and raised questions about the stability of cryptocurrencies generally.

What Is Stablecoin and How Does It Work?

Stablecoins are cryptocurrencies that are designed to maintain a stable value and the term “stable” means that the price of the coin will be kept at a certain level, which can be pegged to fiat currencies such as the US Dollar or gold.

One of the most common forms of stablecoin is Tether (USDT), which is pegged to the US dollar – it is supposed to be exactly equal in value to $1 USDT = $1 USD. If a person holds $1 worth of Tether, then they can exchange it for an equal amount of USD at any time without losing money due to price fluctuations.

Stablecoins are designed to work as a medium of exchange, store of value, and unit of account for the global cryptocurrency ecosystem. A key benefit of stablecoins is that they can be used by companies, exchanges, and consumers in place of volatile cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Stablecoins can be classified into three different categories: fiat or commodity-backed, crypto-backed and algorithmic stablecoins. Fiat-backed stablecoins are backed by actual fiat currency or commodity held in a bank account or vault, while crypto-backed stablecoins use other cryptocurrencies as collateral against which they issue tokens that represent the value of the underlying assets.

Algorithmic stablecoins use algorithms to control supply and demand in order to keep their prices stable. TerraUSD is an example of an algorithmic stablecoin, and it uses algorithms and Luna as collateral to keep its price stable at $1 USD.

Are Stablecoins Actually Stable?

Stablecoins have become a popular topic in the cryptocurrency world, with many new stablecoins cropping up in recent months. However, for the past few weeks, there have been questions about whether or not stablecoins are actually stable – especially with the recent crash of TerraUSD and Luna. These two stablecoins lost their peg to the US dollar and were unable to recover it for several weeks, raising concerns about how reliable crypto assets are.

The creator of TerraUSD, Do Kwon, who purchased $3.5 billion worth of Bitcoin to support TerraUSD, has lent out more than $1 billion worth of Bitcoins worth to help stabilise the price of his coin after it crashed in May. However, critics have pointed out that Kwon’s actions also led directly to the bitcoin price fall.

Joe Downie, CMO at NiceHash said: Terra was launched as a stablecoin backed by their own currency, but it was always a bit of a joke because they didn’t have any real backing.

The idea of a stablecoin is to create an asset that is pegged to the value of another asset, such as the US dollar. However, because TerraUSD was not backed by dollars or any other asset or commodity, it could be seen as a scam.

However, the most significant impacts were felt by investors who had positions in these assets when they crashed. In particular, a large number of accounts had purchased Terra at its peak value and then sold it as it began to decline in price. As a result, these trades incurred significant losses due to the crash.

Many users on Reddit shared their stories, with some posting screenshots of their transactions and others recounting how they lost all their life savings. As always, there was a lot of speculation about the reasons behind the drop in value, but one thing is clear: many investors were caught off guard and lost money.

In a tweet, Crypto exchange Binance founder Changpeng Zhao said he’s poor again after his investment in Luna went up in smoke last month. He had bought $3 million worth of LUNA in 2018 and peaked at around $1.6 billion which is now worth around only $3000.

This is just one example of the cryptocurrency market’s volatility and instability. It raises questions about whether or not these assets are suitable for long-term investments or if they should be treated as short-term trading tools. Many also expressed their belief that there is no such thing as a stable coin, which may be true considering how quickly prices can change in this volatile sector.

Is it A Small 2008 Financial Crisis?

David Gerard, author and crypto journalist, is referring to the incidents that occurred within a week of each other where two stablecoins crashed as “a small 2008 financial crisis”.

The 2008 financial crisis, which was ignited by the collapse of the housing market in the United States and quickly spread to many other countries around the world, has been considered one of the most significant crises in modern history.

The global financial system was on the verge of collapse, as banks were going bankrupt and major companies were failing all over the world. The entire economy suffered from this crash, but it has since recovered.

The speculative nature of cryptocurrency markets, combined with a lack of proper regulation and transparency, has led some to question whether crypto assets are susceptible to similar crises and whether they are stable enough for long-term investment purposes.

The Terra and Luna saga is a cautionary tale of the risks of investing in cryptocurrencies. It’s also a warning to investors that they should be very careful when they take advice from people they don’t know and that they need to do their own research before putting money into any asset class.

Is More Regulation Needed?

As the cryptocurrency market continues to expand and attract new investors, it is important to remember that the current regulatory structure of cryptocurrencies is still in its infancy. The crypto market has experienced a lot of turbulence in the past few years, and some investors are questioning the stability of crypto assets as a result of the recent crash.

Although some countries have implemented restrictions on the buying and selling of digital assets, many others have yet to take action. USA has already begun to take steps toward regulating the crypto market by requiring exchanges to register with the SEC and FINRA. They’ve also imposed restrictions on ICOs, which are tokens issued in exchange for cryptocurrencies or other assets.

Hagen Rooke, financial regulatory counsel at Reed Smith, said that he thinks stablecoins are still very lightly regulated, and the lack of strong regulation around stablecoins is concerning because it could leave investors vulnerable.

Michelle Bond, Chief Executive Officer of the Association for Digital Asset Markets, said that “stablecoins are low-hanging fruit,” and she expects to see some sort of policy for them soon.

Many believe that this lack of regulation is one reason why TerraUSD and Luna Crash have raised questions about the stability of cryptocurrency assets. In addition to being unpredictable and volatile, cryptocurrencies also have less liquidity than traditional stocks or bonds because there are fewer buyers and sellers in the market at any given time.

Many experts argue that current regulations don’t do enough to protect investors and that more rules are necessary to prevent another crash like this one. Others say the market is still new and needs time to grow before regulations should be put in place. They believe that regulation would stunt innovation and make it harder for companies in this space to succeed.

Conclusion

Overall, the collapse of Luna and the Terra stablecoin shook up the entire crypto space. It’s a reminder to investors that there are still no guarantees in this still-young space – and that things may not always go as planned. But it may also be for the best. After all, it is in times of crisis that real change tends to occur.

References

- https://coinmarketcap.com/currencies/terrausd/

- https://coinmarketcap.com/currencies/terra-luna/

- https://www.cnet.com/personal-finance/crypto/what-are-stablecoins-and-are-they-less-risky-the-details-crypto-investors-should-know/

- https://www.cnet.com/personal-finance/crypto/bitcoin-slides-below-30000-amid-wider-economic-downturn/

- https://www.euronews.com/next/2022/05/25/terra-luna-crash-what-are-stablecoins-and-how-stable-are-they-really

- https://www.euronews.com/next/2022/05/12/terra-luna-stablecoin-collapse-is-this-the-2008-financial-crash-moment-of-cryptocurrency

- https://www.livemint.com/market/cryptocurrency/crypto-exchange-binance-founder-says-he-s-poor-again-after-terra-luna-crashes-to-zero-11652977496499.html

- https://www.livemint.com/market/cryptocurrency/terra-luna-crash-sparks-caution-in-crypto-market-what-should-investors-do-11653054348569.html

Written by The Original PC Doctor on 17/6/2022.

My experience as i fell victim to a fake investment wasn’t a pleasant one as i figured out when it was already too late to be a well orchestrated and organized ponzi scheme. I ended up losing USD342k of my life savings. I made a police report and they made me understand nothing could be done to recover my lost funds since it was an internet transaction with unknown person.

I finally came to my redemption as the work and hand of God came upon my life led me to see comments about Refundd Polici on google search about their successful stolen crypto and lost funds recovery rates so it gave me a glimpse of hope. I resorted to seeking assistance from them and it proved positive and fruitful. It was a smooth experience for me as they patiently guided me through the recovery phases using the information i provided about my stolen bitcoin experience including the screenshots and wallet address.