New Technology to Reduce Scams in Banking

Banking Scams are a major problem in Australia, and banks are taking steps to reduce them using new technologies like name matching. This technology matches the name of the person making a transaction with the name of the person who owns the account. If the names don’t match, the transaction will be flagged for further review.

Name matching is a promising technology, but it is also a monumental task due to the old systems and technologies used by Australian banks. The future of banking is uncertain, but it is likely to be shaped by technology, online banking, and new financial technologies like blockchain. If you suspect your online banking has been compromised, seek assistance from the Original PC Doctor at 1300 723 628.

New Technology to Reduce Scams in Banking

Scams are a major problem in Australia, costing the economy billions of dollars each year. In recent years, there has been a surge in online scams, which are often difficult to detect and prevent.

One of the most common types of online scams is phishing, where scammers send emails or text messages that appear to be from legitimate companies, such as banks or government agencies. These emails or text messages will often contain a link that, if clicked, will take the victim to a fake website that looks like the real website. Once the victim enters their personal information on the fake website, the scammers can steal their identity or access their bank accounts.

Another common type of online scam is identity theft, where scammers steal personal information, such as social security numbers, credit card numbers, and driver’s license numbers. This information can then be used to open new accounts in the victim’s name or to make fraudulent purchases.

Banks are taking a number of steps to reduce scams, including using artificial intelligence (AI) to detect suspicious activity and developing new technologies to verify customer identities.

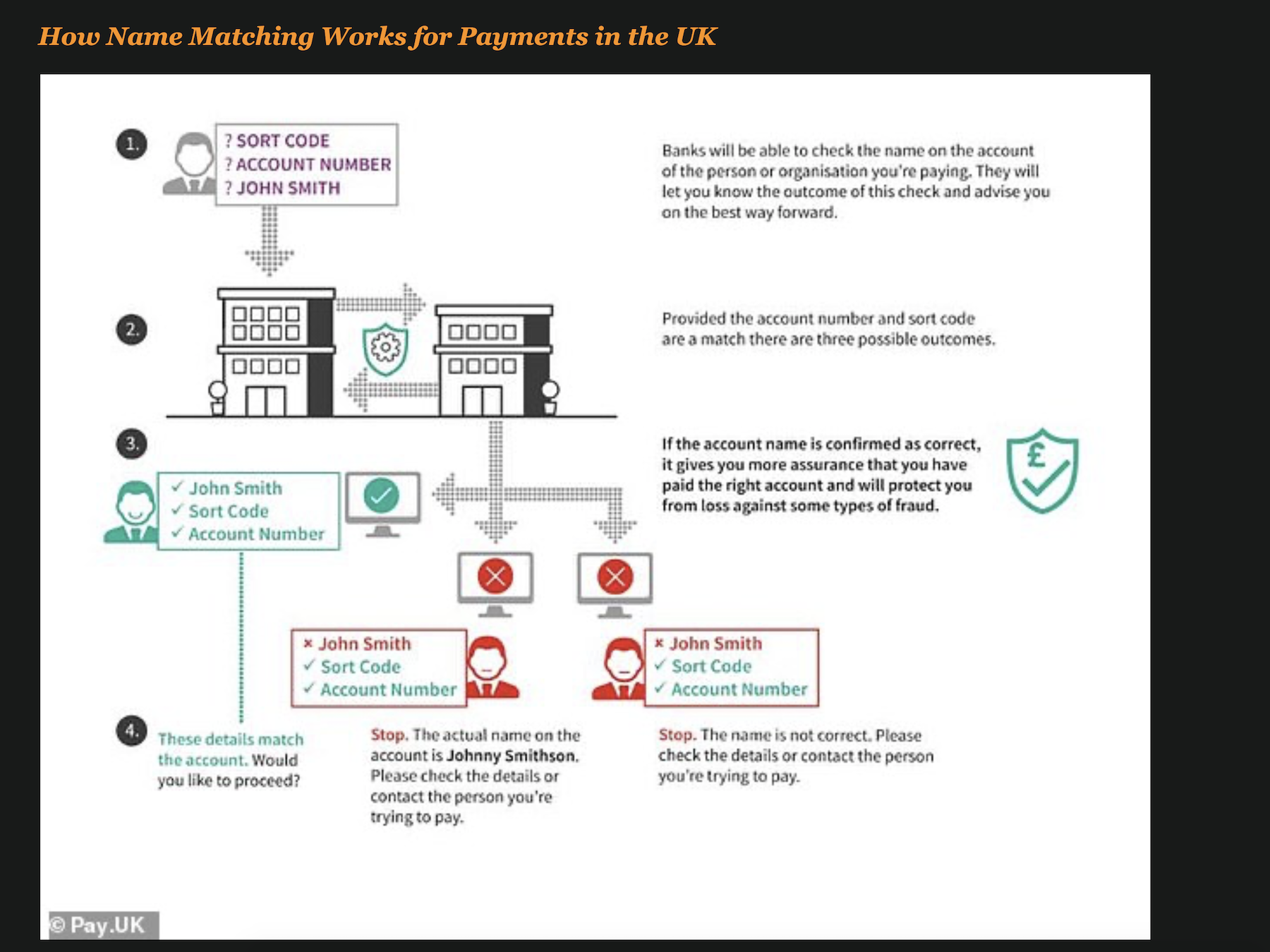

One new technology that is being used to reduce scams is called “name matching.” This technology matches up the name of the person making a transaction with the name of the person who owns the account. If the names don’t match, the transaction will be flagged for further review.

Name matching is a promising technology, but it is also a monumental task as ACCC had called out for banks to implement the technology for years. The banks in Australia are running very old systems and technologies, and it will take a lot of time and money to implement name matching.

How do the name matching work in the banking industry

The History of Banking in Australia

The first bank in Australia was established in 1817. The bank was called the Bank of New South Wales. In the years that followed, many other banks were established in Australia.

In the 1900s, the Australian government began to regulate the banking industry. The government created the Reserve Bank of Australia (RBA) in 1911. As Australia’s central bank, the RBA is responsible for setting monetary policy and overseeing the banking industry.

In the 1980s and 1990s, there was a period of deregulation in the Australian banking industry. This led to a number of mergers and acquisitions, and the creation of a number of new banks.

How Many People Bank in Australia?

There are over 24 million people in Australia, and almost all of them have a bank account. The most popular type of bank account in Australia is a savings account.

The Future of Banking

The future of banking is uncertain, but it is likely to be shaped by a number of factors, including:

- The increasing use of technology

- The growing popularity of online banking

- The rise of new financial technologies, such as blockchain

Blockchain is a distributed ledger technology that has the potential to revolutionise the way we bank. Blockchain is a secure and transparent way to store and transfer data. It could be used to create new and innovative banking products, such as:

- A new way to track ownership of assets

- A new way to make payments

- A new way to verify identities

Conclusion

The banking industry is facing a number of challenges, but it is also poised for a period of great innovation. New technologies, such as name matching and blockchain, have the potential to make banking more secure, more convenient, and more accessible.

In addition to the information above, here are some additional notes:

- The Australian government is committed to reducing scams, and it has a number of initiatives in place to do so.

- Banks are working closely with law enforcement to identify and prosecute scammers.

- Customers can play a role in reducing scams by being aware of the common scams and by being careful about the information they share online.

I hope this blog post has been informative.

To check out the Australian Government resources for cyber security click this link below: https://www.cyber.gov.au/

Written by John Pititto on 25/11/2023.